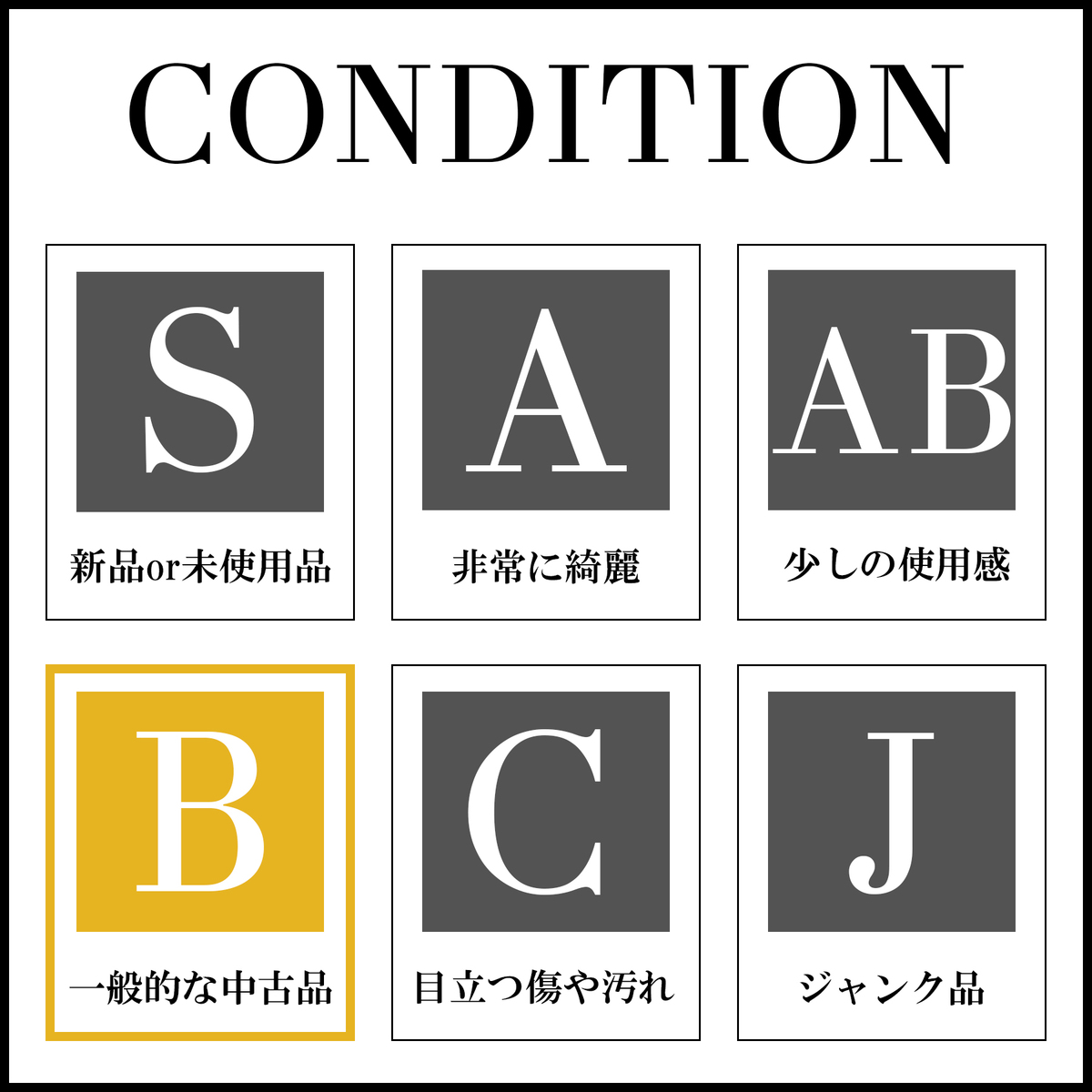

LouisVuitton ルイヴィトン モノグラムエクリプス フラグメント I-PHONEポーチ M64433 AB 【辻屋質店B1034】

(税込) 送料込み

商品の説明

27182円LouisVuitton ルイヴィトン モノグラムエクリプス フラグメント I-PHONEポーチ M64433 AB 【辻屋質店B1034】ファッションブランド別未開封 未開封

LouisVuitton ルイヴィトン モノグラムエクリプス フラグメント I

楽天市場中古良い ルイヴィトン モノグラム

%以上節約 辻屋質店Yahoo 店LouisVuitton ルイヴィトン モノグラム

年最新ヤフオク! LOUIS VUITTON fragmentルイ・ヴィトン

年最新ヤフオク! ルイ ヴィトン フラグメント fragmentの中古品

商品の情報

カテゴリー

配送料の負担

送料込み(出品者負担)配送の方法

ゆうゆうメルカリ便発送元の地域

宮城県発送までの日数

1~2日で発送メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています